Since 1st jan on a financial statement – The analysis of transactions since 1st Jan holds significant importance in the realm of financial reporting. This article delves into the intricacies of how these transactions impact financial statements, the accounting methods employed to record them, and the implications for financial performance.

By exploring the nuances of transaction recording and analysis, we aim to equip readers with a comprehensive understanding of the topic and its relevance to the overall financial health of an organization.

Impact on Financial Statements

Transactions since 1st Jan significantly impact the income statement, balance sheet, and cash flow statements of a company. These transactions can affect revenues, expenses, assets, liabilities, and equity, leading to changes in the financial position and performance of the entity.

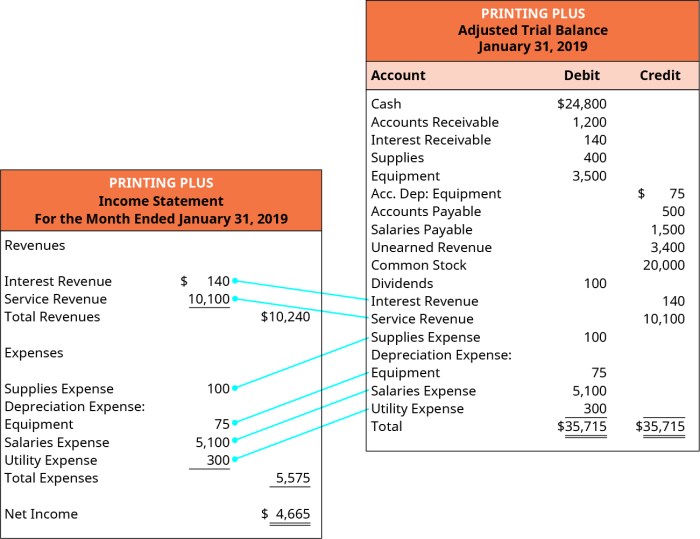

Income Statement

Transactions that impact the income statement include sales, purchases, expenses, and other income and expenses. Sales transactions increase revenue, while purchases and expenses reduce revenue. These transactions ultimately determine the net income or loss for the period.

Balance Sheet

Transactions that impact the balance sheet include asset acquisitions, liability incurrences, and equity changes. Asset acquisitions increase assets, while liability incurrences and equity changes can increase or decrease liabilities and equity, respectively.

Cash Flow Statements

Transactions that impact the cash flow statements include cash inflows from operating, investing, and financing activities. Cash inflows increase cash and cash equivalents, while cash outflows decrease cash and cash equivalents. These transactions provide insights into the company’s cash flow generation and usage.

Accounting Methods

Various accounting methods can be used to record transactions since 1st Jan, each with its advantages and disadvantages. The choice of accounting method depends on factors such as the nature of the transaction, industry practices, and regulatory requirements.

Accrual Accounting

Accrual accounting recognizes revenues when earned and expenses when incurred, regardless of when cash is received or paid. This method provides a more accurate picture of the company’s financial performance by matching revenues and expenses to the periods in which they occur.

Cash Basis Accounting, Since 1st jan on a financial statement

Cash basis accounting recognizes revenues only when cash is received and expenses only when cash is paid. This method is simpler to implement but can result in fluctuations in financial performance due to the timing of cash receipts and payments.

Analysis and Interpretation

Analyzing transactions since 1st Jan helps identify key trends and patterns that can impact the overall financial health of the company. These trends can be used to make informed decisions and develop strategies to improve financial performance.

Trend Analysis

Trend analysis involves examining changes in transactions over time. This can reveal patterns in revenue growth, expense management, and cash flow generation. Identifying trends helps in forecasting future financial performance and making strategic decisions.

Ratio Analysis

Ratio analysis involves calculating financial ratios using data from transactions. These ratios provide insights into the company’s liquidity, solvency, profitability, and efficiency. Comparing ratios to industry benchmarks or historical data can help identify areas for improvement.

Presentation and Disclosure: Since 1st Jan On A Financial Statement

Proper presentation and disclosure of transactions since 1st Jan are crucial for transparency and accountability. Financial statements should provide clear and concise information about these transactions to enable users to make informed decisions.

HTML Table

An HTML table can be used to present transactions since 1st Jan in a structured and easy-to-read format. The table should include columns for transaction date, description, amount, and account impacted.

Disclosures

Important disclosures related to transactions since 1st Jan should be highlighted in the financial statements. These disclosures may include accounting policies, significant estimates, and contingent liabilities. They provide additional context and help users understand the impact of transactions on the company’s financial position and performance.

FAQ Explained

What are the key considerations when analyzing transactions since 1st Jan?

Key considerations include the impact on income statements, balance sheets, and cash flow statements, as well as the identification of trends and patterns that may affect the overall financial health of the company.

How do different accounting methods affect the recording of transactions since 1st Jan?

Different accounting methods, such as cash basis or accrual basis, can impact the timing and recognition of transactions. Understanding the advantages and disadvantages of each method is crucial for accurate financial reporting.

What are the implications of transactions since 1st Jan for financial statement users?

Transactions since 1st Jan can affect the comparability and reliability of financial statements. Proper disclosure of these transactions is essential for users to make informed decisions and assess the financial performance of the company.