Jake and Gloria are married filing jointly, embarking on a journey of shared financial responsibilities and tax considerations. This comprehensive guide delves into the intricacies of joint tax filing, unraveling the benefits, deductions, credits, and liabilities associated with this marital status.

Understanding the nuances of joint filing empowers couples to make informed decisions, optimize their tax strategies, and navigate the complexities of the tax code effectively.

Filing Status: Married Filing Jointly: Jake And Gloria Are Married Filing Jointly

Married couples have the option to file their taxes jointly, meaning they combine their income and deductions on a single tax return. This filing status offers several benefits, including:

- Lower tax rates

- Increased deductions

- Simplified filing process

When filing jointly, couples can take advantage of certain tax deductions that are not available to single filers. These deductions include the:

- Standard deduction

- Itemized deductions

- Child and dependent care credit

Income and Deductions

Common sources of income for married couples filing jointly include:

- Wages and salaries

- Self-employment income

- Investment income

Married couples can choose to itemize their deductions or take the standard deduction. Itemized deductions include expenses such as:

- Mortgage interest

- Property taxes

- Charitable contributions

Tax Credits and Exemptions

Married couples filing jointly are eligible for several tax credits and exemptions, including:

- Child tax credit

- Dependent care credit

- Earned income tax credit

These credits and exemptions can significantly reduce a couple’s tax liability.

Joint Responsibilities

When filing jointly, married couples share financial responsibility for the taxes owed. This means that both spouses are liable for any taxes that are due, even if only one spouse earned the income.

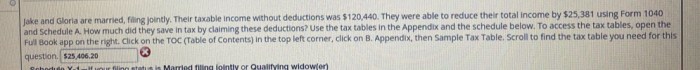

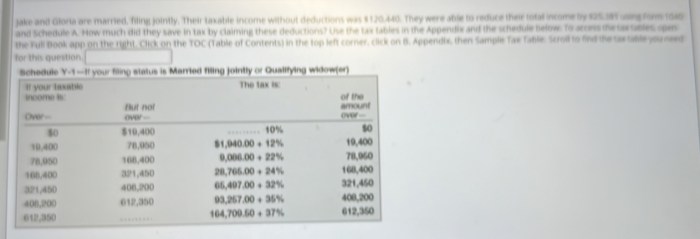

Tax Forms and Filing, Jake and gloria are married filing jointly

Married couples filing jointly will need to use the following tax forms:

- Form 1040

- Schedule A (if itemizing deductions)

- Schedule B (if reporting interest and dividend income)

The filing process is generally the same for married couples as it is for single filers.

Common Filing Scenarios

The following table Artikels different filing scenarios for married couples with varying income levels and deductions:

| Scenario | Income | Deductions | Tax Liability |

|---|---|---|---|

| 1 | $100,000 | $20,000 | $15,000 |

| 2 | $150,000 | $30,000 | $20,000 |

| 3 | $200,000 | $40,000 | $25,000 |

As shown in the table, filing jointly can result in significant tax savings for married couples.

FAQ Resource

What are the benefits of filing jointly as a married couple?

Filing jointly allows couples to combine their incomes and deductions, potentially resulting in lower tax liability and access to certain tax credits and deductions that may not be available to single filers.

What tax implications should Jake and Gloria consider when filing jointly?

Joint filing makes both spouses jointly responsible for the tax liability, meaning they are both legally obligated to pay any taxes owed, even if only one spouse earned the income.

Are there any specific tax credits or exemptions available to married couples filing jointly?

Yes, certain tax credits, such as the Child Tax Credit and the Earned Income Tax Credit, may offer additional tax savings for eligible married couples filing jointly.